At the Law Offices of Paul P. Cheng & Associates, we continue to monitor major developments in California employment law, particularly those that impact hardworking employees across the state. One recurring issue is the misclassification of non-exempt employees as exempt, which can result in significant losses in unpaid wages, overtime, and mandated break periods.

If you’ve ever been denied overtime, forced to work through lunch, or not given rest breaks, your employment classification may be to blame.

Understanding the Basics: Exempt vs. Non-Exempt

Under California law, non-exempt employees are protected by labor laws that entitle them to:

- Overtime pay

- Meal and rest breaks

- Minimum wage

Exempt employees, on the other hand, are not eligible for those protections—but only if they meet strict criteria under the law, including:

- Performing primarily executive, administrative, or professional duties;

- Regularly exercising independent judgment; and

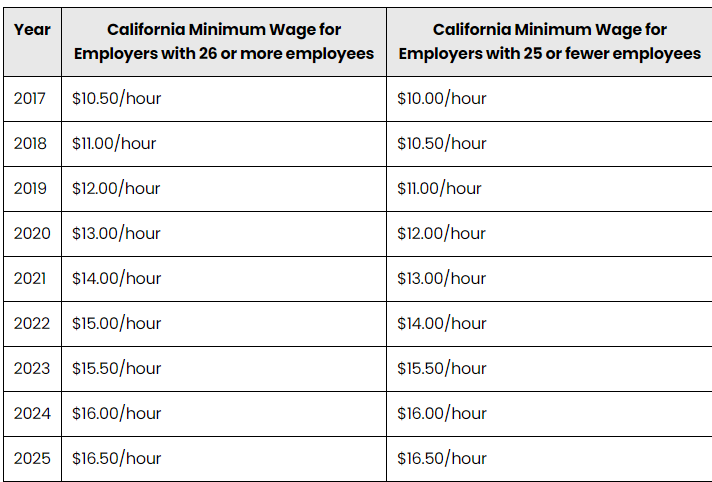

- Earning at least twice the minimum wage based on a 40-hour workweek.

As of January 1, 2025, that threshold equals $68,640 annually, based on the California minimum wage of $16.50/hour.

Importantly, job titles alone do not determine exemption status. An “Executive Assistant” or “Manager” may still be non-exempt if their actual duties or pay do not meet the legal standard.

Common Signs of Misclassification

You may be misclassified as an exempt employee if:

- You’re paid a fixed salary, but your employer docks your pay for partial days off

- Your salary falls below $68,640 annually

- You don’t regularly exercise discretion or independent judgment at work

- You’re performing primarily administrative or manual tasks without leadership responsibilities

Even if you once qualified as exempt, a change in job duties—such as a demotion, reorganization, or reassignment—may trigger a loss of exempt status.

Why Would an Employer Misclassify You?

Some employers—knowingly or unknowingly—misclassify employees in an attempt to:

- Avoid paying overtime

- Eliminate the need to track hours

- Skip providing legally required meal and rest breaks

- Cut labor costs under the assumption that salaried employees can work unlimited hours

However, misclassification can backfire, exposing employers to significant liability, including:

- Back pay for unpaid overtime

- Penalties for missed breaks

- Interest

- Attorney’s fees and court costs

Retaliation Is Illegal

Worried about speaking up? California law prohibits employers from retaliating against employees who report wage violations or question their classification. Any demotion, pay cut, or termination in response to such complaints may amount to wrongful termination or unlawful retaliation.

Legal Remedies Available

If you've been misclassified, you may be entitled to:

- Unpaid overtime wages

- Compensation for missed meal/rest breaks

- Minimum wage back pay

- Double damages under federal law in certain cases

- Attorney’s fees and court costs

In some cases, misclassification affects multiple employees, creating the basis for a class action lawsuit—a powerful tool for workers to recover wages owed to them.

Know Your Rights—And Act

At PPRCLaw, we’ve successfully represented both employees and employers across a wide range of industries. Whether you believe you’ve been misclassified or you’re an employer seeking guidance on proper classification and compliance, we’re here to help.

If you suspect a misclassification issue—or want to ensure your company is following California’s strict labor laws—contact us today for a confidential consultation.